cap and trade vs carbon tax canada

Heres a primer on carbon taxes and cap and trade in Canada. Quebecs cap and trade system provides 100 relief to process emissions.

Carbon Pricing Is Here To Stay In Canada What Is It Anyway Youtube

Alberta is emulating BC.

. Heres what you need to know about carbon pricing how it works and why it is a signature part of Ottawas plan to. W hile political leaders in the Eu-ropean Union Canada Aus-tralia Japan and the US. The policy is meant to encourage companies and households to pollute less and invest in.

Goulder and Andrew Schein NBER Working Paper No. Carbon Tax vs. Carbon taxes vs.

Cap and Trade vs. Starting in 2021 process emissions will be subject to a tightening rate of 05 per year. Not quite yet I prefer a carbon tax over cap-and-trade but cap-and-trade over nothing Appalachian State economics professor John Whitehead wrote on the Environmental Economics blog last week.

With a carbon tax there is an immediate cost to. Joe wasnt defending cap-and-trade as such against the carbon tax alternative -- he was defending Waxman-Markey including all its complementary policies against the tax alternative Ryan Avent says taxes and caps are not that different in effect and only one has a chance of passing so carbon taxers should STFU. A carbon tax sets the price of carbon dioxide emissions and allows the market to determine the quantity of emission reductions.

Canadas federal carbon tax increases on April 1. With cap-and-trade units of carbon are initially given out for free meaning there is no upfront cost to firms. Essay on Carbon Tax vs.

The cap-and-trade model Papy said has proven it can help that transition while at the same time limiting the social outcry that accompanied carbon tax hikes in France and to a lesser extent in. If youre hungry for WSJ energy news but too busy to flip through the entire paper to find it heres a quick roundup. In a carbon tax scenario emitters must pay for every ton of GHG they emit - thereby creating an incentive to reduce emissions in the house as much as possible to avoid the tax burden.

Cap and trade on the other hand aims to put a. Each approach has its vocal supporters. Californias cap and trade system provides additional relief to sectors at high risk of carbon leakage and with more than 50 process emissions.

Cap and trade and a carbon tax are two distinct policies aimed at reducing greenhouse gas GHG emissions. Cap and Trade. While the Liberals say its essential to have a carbon tax that will rise to 170 a tonne by 2030 Quebecs cap-and-trade plan currently equals a carbon price of just 17 a tonne.

Cap and Trade 1290 Words 6 Pages All across the world in every kind of environment and region known to man increasingly dangerous weather patterns and devastating storms are abruptly putting an end to the long-running debate over whether or not climate change is real. A carbon tax and cap-and-trade system complement each other ensuring there is a price on CO2 emissions across the entire economy given that a cap-and-trade system typically covers large stationary sources of emission at the production end while a carbon tax addresses the consumption end. Cap and trade and Saskatchewan opposes carbon pricing.

Stavins1 Harvard Kennedy School This paper compares the two major approaches to carbon pricing carbon taxes and cap and trade in the context of a possible future climate policy and does so. Carbon taxes and cap-and-trade schemes both add to the price of emitting CO2 albeit in slightly different ways. With a cap and trade scenario emitters have the flexibility to reduce emissions in the house or purchase allowances from other emitters who have achieved surplus reductions of their own.

Peter MacdiarmidGetty Images G r. A carbon tax puts a price on the impact of emissions on Canadas environment and economy. Cap-and-Trade or a Carbon Tax.

The theory behind the carbon tax is that it provides an incentive for businesses to start using cleaner fuels as it becomes too expensive to continue polluting carbon into the atmosphere. This can be implemented either through a carbon tax known as a price instrument or a cap-and-trade scheme a so-called quantity instrument. With a carbon tax Ontario and Quebec favour.

A Critical Review Lawrence H. Carbon taxes and cap-and-trade are ways to price carbon but they both have some key differences. A carbon tax and cap-and-trade are opposite sides of the same coin.

H23Q50Q54 ABSTRACT We examine the relative attractions of a carbon tax a pure cap-and-trade system and a hybrid option a cap-and-trade system with a price ceiling andor price floor. A carbon tax imposes a tax on each unit of greenhouse gas emissions and gives firms and households depending on the scope an incentive to reduce pollution whenever doing so would cost less than. A carbon tax directly establishes a price on greenhouse gas emissionsso companies are charged a dollar amount for every ton of emissions they producewhereas a.

Congress move toward cap-and-trade systems as their preferred approach for achieving meaningful reductions in emissions of CO 2 and other greenhouse gases there is a lively debate among econo-. A carbon tax has a major advantage over cap-and-trade and a hybrid version because it allows for carbon price certainty is less costly to administer and is a substantial source of revenue. However a cap-and-trade policy offers its own advantages in that emissions allowances can be allocated so as to minimize the policys negative effects on.

19338 August 2013 JEL No. Theory and practice Robert N. A carbon tax will be applied to gas diesel and natural gas but large emitters will face additional measures.

Those in favor of cap and trade argue that it is the only approach that can guarantee that an environmental objective will be achieved has been shown to effectively work to protect the environment at. 12 2007 828 am ET.

Economist S View Carbon Taxes Vs Cap And Trade

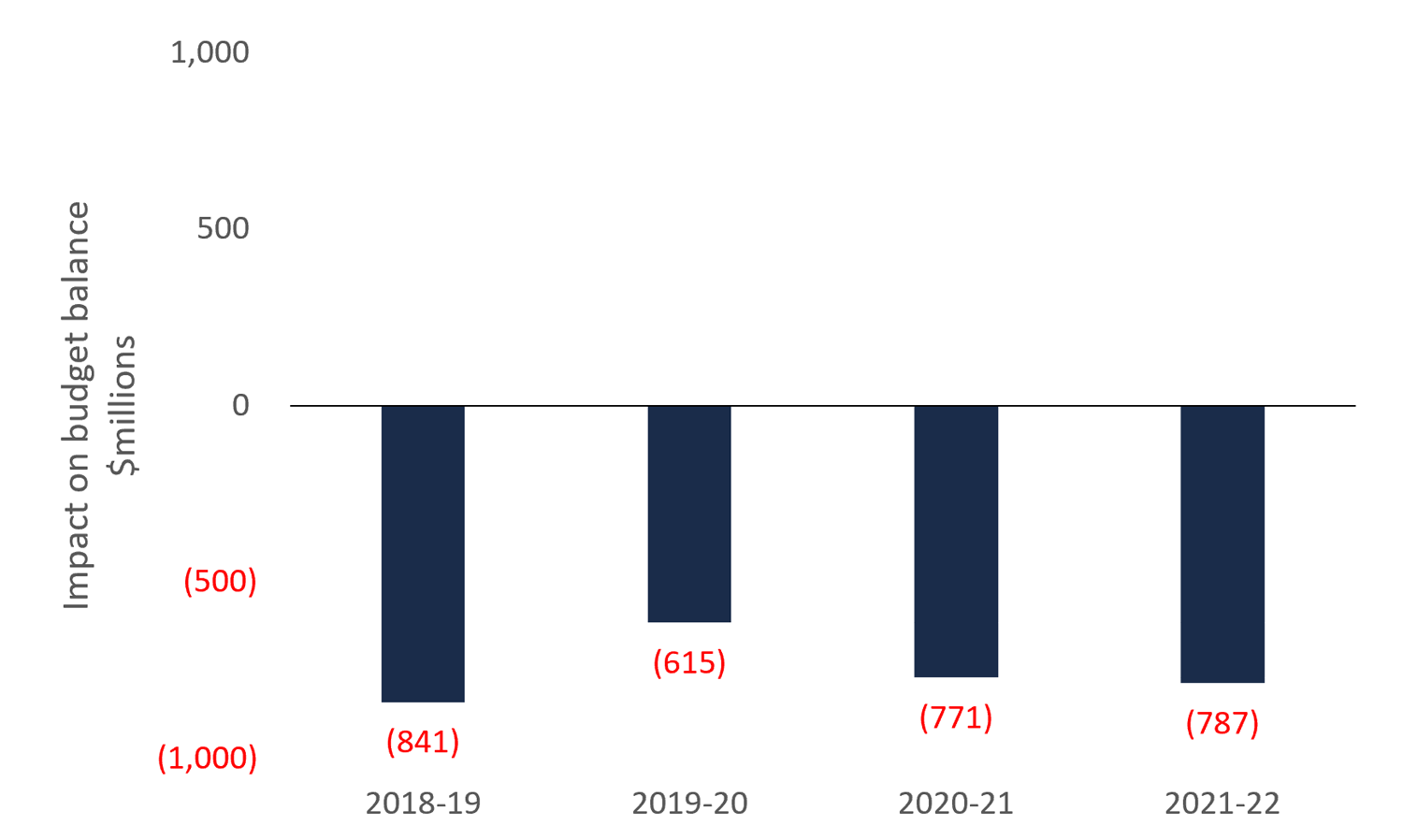

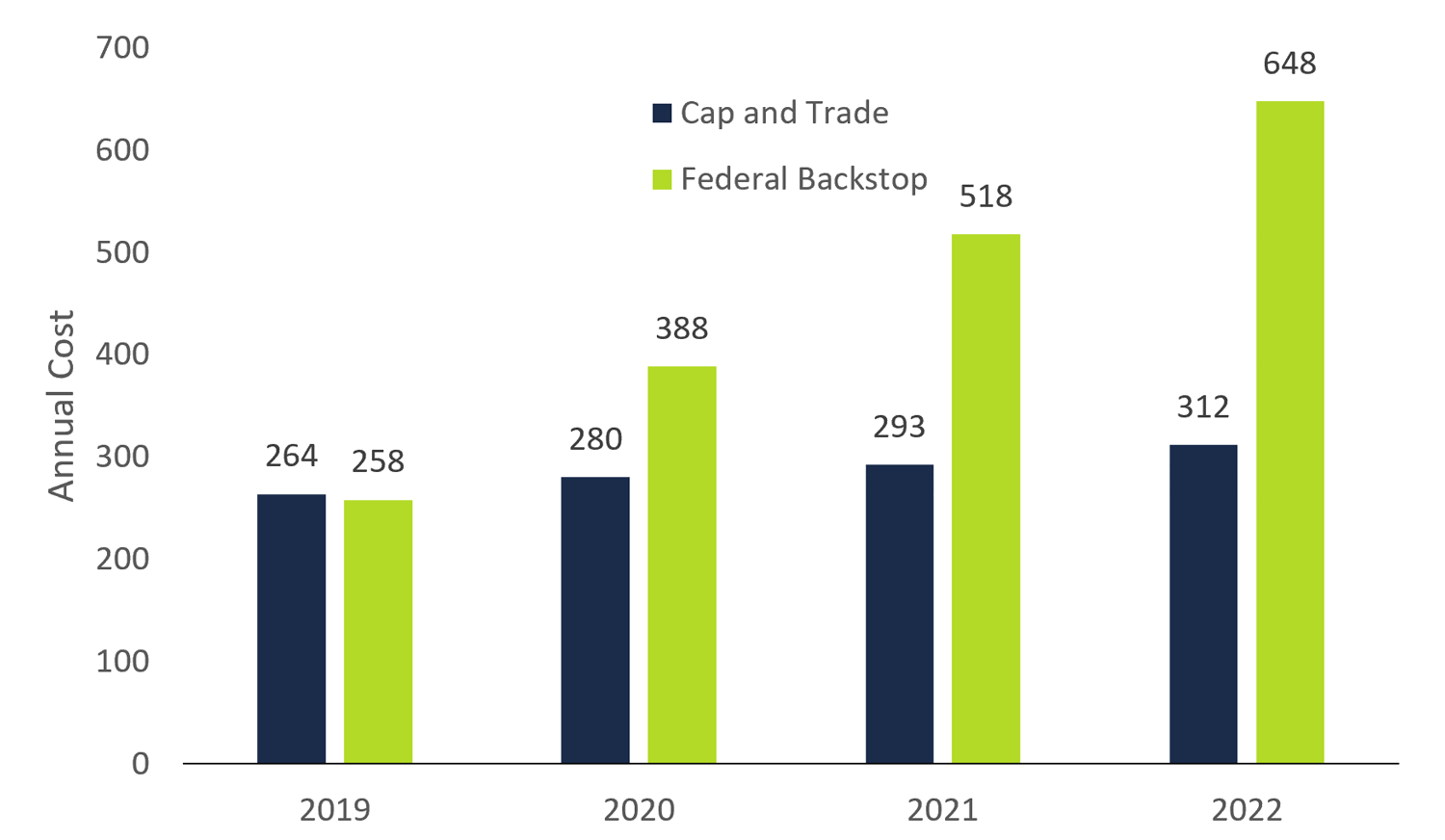

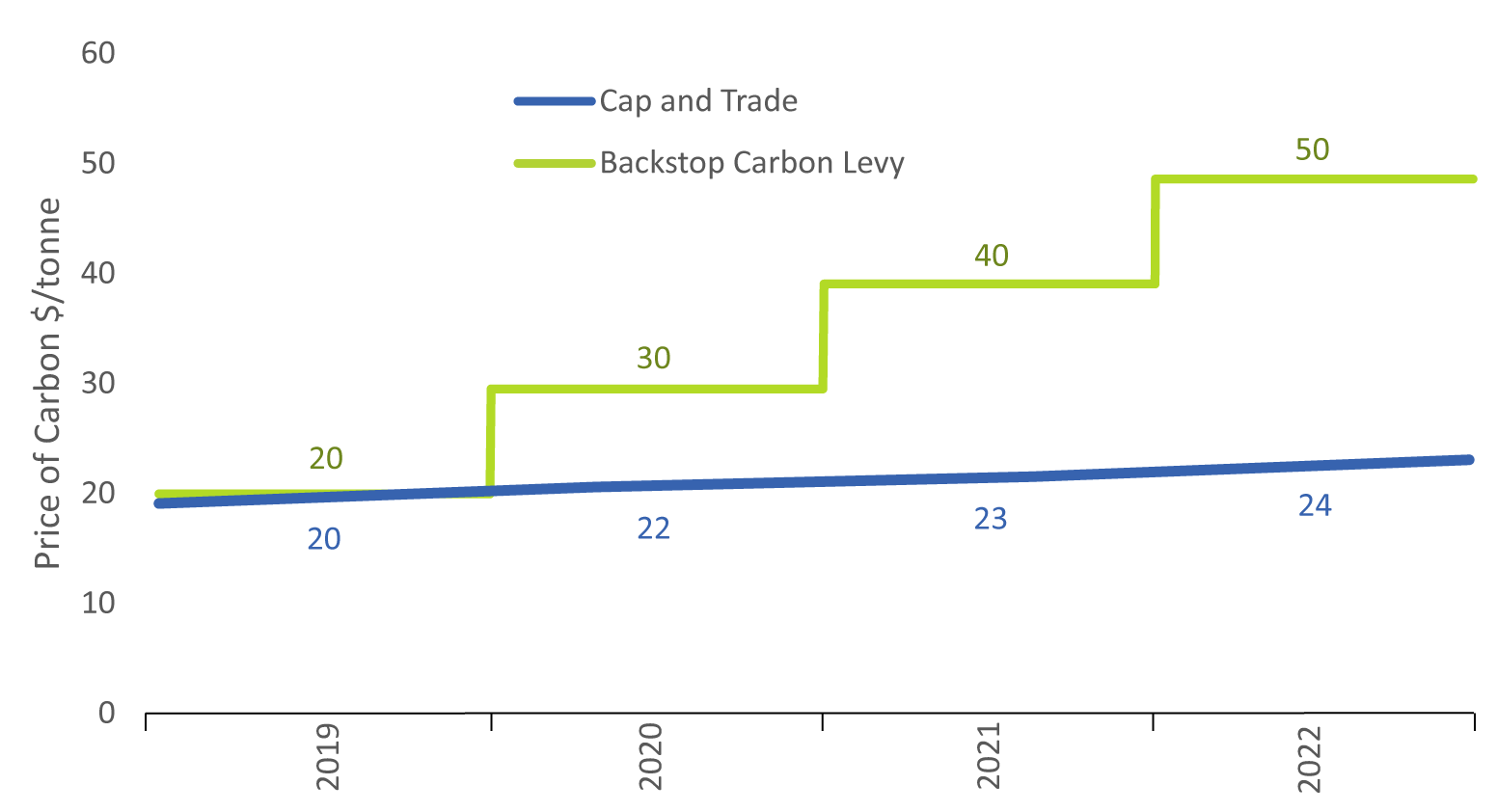

Cap And Trade A Financial Review Of The Decision To Cancel The Cap And Trade Program

The Pros And Cons Of Carbon Taxes And Cap And Trade Systems Semantic Scholar

Difference Between Carbon Tax And Cap And Trade Difference Between

The World Urgently Needs To Expand Its Use Of Carbon Prices The Economist

Cap And Trade A Financial Review Of The Decision To Cancel The Cap And Trade Program

Difference Between Carbon Tax And Cap And Trade Difference Between

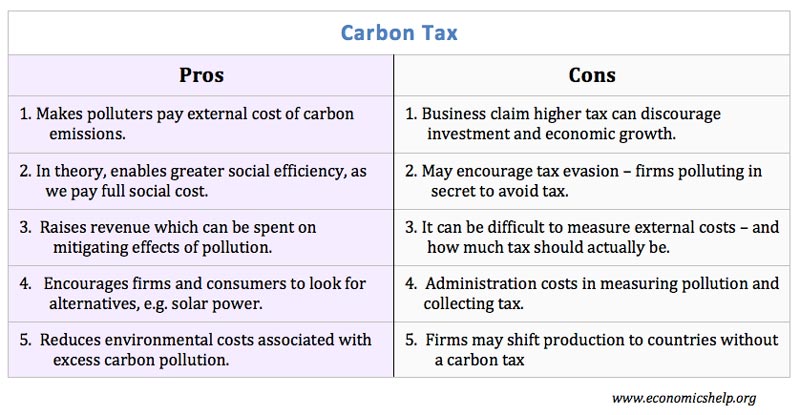

Carbon Tax Pros And Cons Economics Help

The Pros And Cons Of Carbon Taxes And Cap And Trade Systems Semantic Scholar

Your Cheat Sheet To Carbon Pricing In Canada Delphi Group

Cap And Trade A Financial Review Of The Decision To Cancel The Cap And Trade Program

Nova Scotia S Cap And Trade Program Climate Change Nova Scotia

All You Need To Know About Bc S Carbon Tax Shift In Five Charts Sightline Institute

How To Design Carbon Taxes The Economist

Alberta Carbon Tax Deep Dive Not A Job Killer Competitive Advantage For Oil Sands Producers Thoughtful Journalism About Energy S Future

Carbon Policy Bc Carbon Tax Link To The World

Difference Between Carbon Tax And Cap And Trade Difference Between